Press Releases

Dr. Bucshon Supports Permanent Tax Cuts

Washington,

September 28, 2018

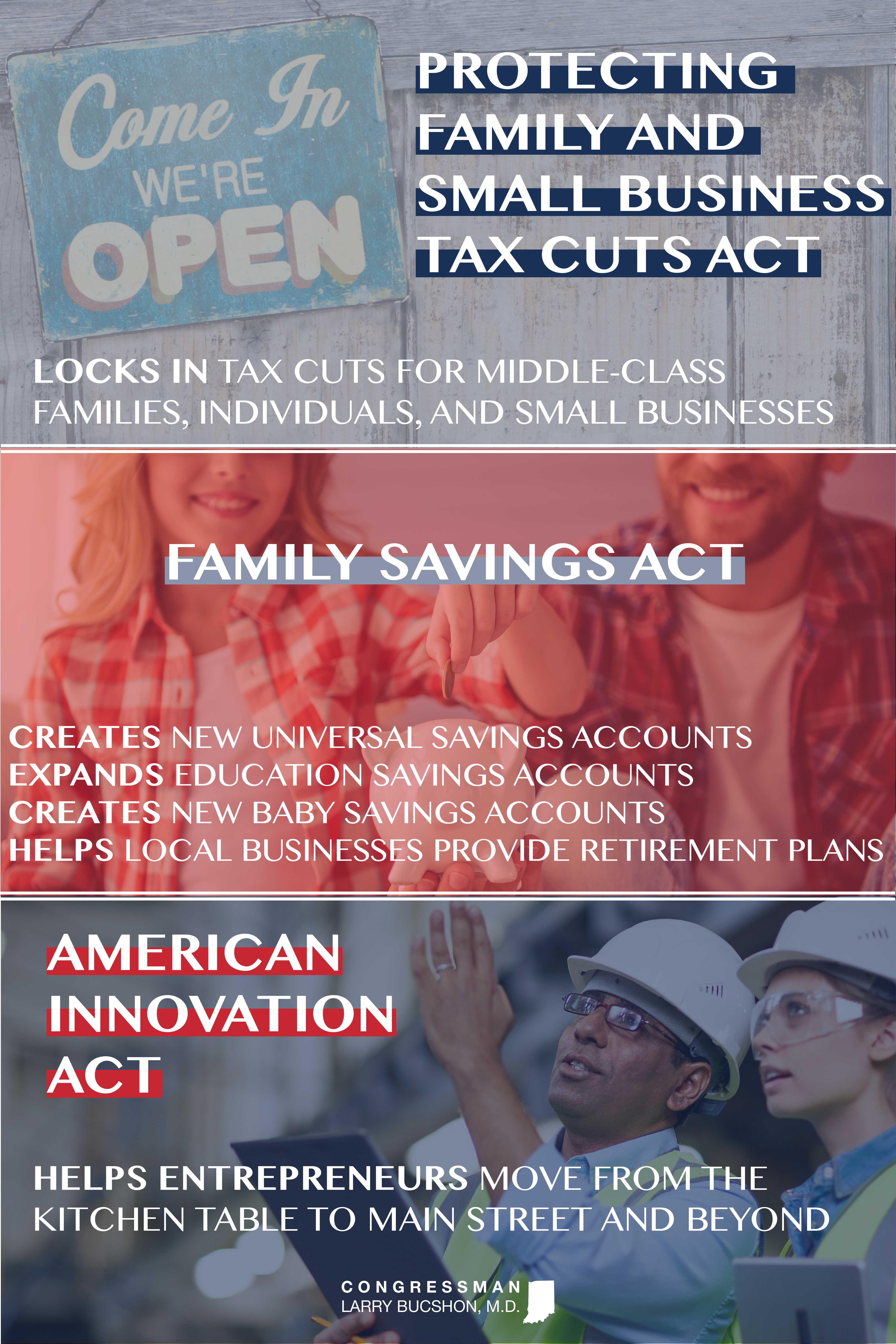

“The Tax Cuts and Jobs Act has had a tremendously positive impact on the American economy. Today, we have one of the most competitive tax codes in the world – wages have increased, the economy grew by more than 4% in the last quarter, and for the first time, there are more available jobs than there are people looking for work. Unfortunately, because Washington Democrats did not support the tax cuts, we must now pass additional legislation that will make the tax cuts for middle-class families and small businesses permanent. This is important because small businesses are the backbone of America and a strong middle-class means a strong, sustained America.” Background Protecting Family and Small Business Tax Cuts Act (H.R. 6760) Makes these provisions permanent · Lower tax rates · A doubled Child Tax Credit · Paid Family Leave Tax Credit · Elimination of the Alternative Minimum Tax · Doubled exemption from the Death Tax Family Savings Act (H.R. 6757) · Allowing small businesses to join together to create a 401(k) plan more affordably · Giving employers more time to put new retirement plans in place · Simplifying the rules for participation in employer plans · USA accounts. Creating a new Universal Savings Account (USA) to offer a fully flexible savings tool that families can use any time that’s right for them. · Expanded 529 Education accounts. Building upon the improvements to education savings accounts in the Tax Cuts and Jobs Act by providing families with the flexibility to also use their education savings to pay for apprenticeship fees to learn a trade, cover the cost of home schooling, and help pay off student debt. · New Baby savings. Allowing families to access their own retirement accounts on a penalty-free basis to use as they see fit when welcoming a new child into the family, whether by birth or adoption. And allowing families to replenish those retirement accounts in the future. American Innovation Act (H.R. 6756) · Allowing new businesses to write off more of their initial start-up costs · Allowing start-ups to expand by bringing in new investors without triggering limits on their access to tax benefits like the R&D credit for activities conducted in their early years |